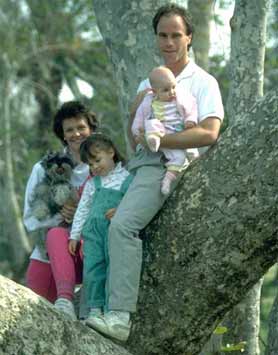

Family Health Discount

(Sponsored article from New India Assurance)

Family: " Family" comprises the insured and any one or more of the following:

- Spouse

- Eligible dependent Children above the age of 3 months (maximum two children)

- Dependent parents/ Parents in laws (below the age of 60 years)

All members of a family should be covered without any selection. However, Regional Offices can consider exceptional cases on merits.

Discounts:

- Family discount: 10% discount in premium for covering family members

- Mid term inclusion is allowed for child attaining age of 3 months and newly married spouse by charging pro-rata premium for the remaining period of the policy. No family discount is permissible for such mid term inclusion.

The proposer can take the policy for dependent brothers and sisters residing with him but they will not be eligible for family discount.

- Loyalty discount: The proposer with age less than 40 years is entitled for Loyalty Discount on renewal without break. This discount will be given when the insured enters the next age band. The Loyalty Discount is 10% of Gross renewal premium for the family and the same will be withdrawn permanently when a claim is lodged under the policy for any member of the family.

Good health discount: Members of recognized Health club/ Gymnasium are eligible for a 2.5% "good health discount" in premium on fresh and renewal policies, subject to documentary proof of up to date membership. Dependents will be eligible for this discount only if they are also members of the Health Club/ Gymnasium.

- Sum insured: The minimum sum insured per person under the policy is Rs 1 lack and thereafter-in multiples of Rs 25,000/- upto Rs 3 lakhs and thereafter-in multiple of Rs 50,000/- up to Rs 5 lakhs.

- Fixation of sum insured: The minimum sum insured under the Mediclaim policy (2007) is Rs one lakh. A person holding the current policy with sum insured less than Rs one lakh can renew it as Mediclaim policy for Rs one lakh without any pre health check up. Alternatively, the insured can opt for Janata Mediclaim Policy. The sum insured for each of the family members should be equivalent to that of proposer. However for dependent children the sum insured can be up to 50% of the proposer's sum insured subject to minimum Rs one lakh.

- Mid term increase in sum insured will not be allowed.

- Enhancement of the sum insured can be done at the time of renewal subject to satisfactory pre acceptance health check up, irrespective of age. No enhancement in sum insured shall be allowed to persons above 60 years of age.

Insured persons suffering from chronic ailments of recurring nature should not be considered for enhancement of the sum insured.

Persons suffering from incurable/chronic diseases needing recurring treatment of any kind, such as renal failure, cancer, Parkinson's disease, Diabetes Mellitus, type 2, etc will not be eligible for the

- Premium rates: The revised premium rates are based on geographical area wise claim experience, the following 3 zones have been made for rating: Zone :I(Mumbai): Zone II (Delhi & Banglore) and Zone III (Rest of India). Premium will be charged depending on the Zone in which the sum insured undertakes to seek hospitalization. The number of Zones could be increased/decreased in future by the company.

(Sponsored article from New India Assurance)