- Best Health Insurance Policy in India - (https://www.apnapaisa.com/insurance/health-insurance-india/index.html)

About

Health insurance is one definite way towards achieving ‘health for all’ in the world. Most governments including the US government are striving towards this goal. UK already has the National Health Service and so have most European countries. But it is the lesser developed countries that need to get health insurance high on the government’s priorities and demand a higher chunk of the GDP.

In India, health insurance is gathering momentum, with many state governments tying up with private insurance companies to provide decent health cover for their people. Healthcare in India is seeing a gradual shift of focus from public sector hospitals to private corporate hospitals. However, by and large the common man is still ignorant about the very concepts of Insurance. Health Insurance is only a component of different types of insurance cover.During the last elections - ‘Health insurance for people’ became a new mantra for capturing vote-banks in some states of India. It is very well for the government to give pledges to the people to win votes, but the challenge to deliver decent health-care to their subjects in the comfort of the corporate hospitals is likely to be daunting. The premium paid is sometimes very meager and can provide for very little.

Understanding the fine print of the insurance will help you understand the scope of the policy and its limitations, which are seldom spelled out by the agent selling you their products. This article has been created specially for the layman, to explain, discuss and interpret only the important clauses incorporated under Health Insurance Policy by various PSUs (Public Sector Undertakings) and Private Insurance Companies in India.

Before discussing and interpreting the important clauses as stated in the policy cover, it is important to note that there are no standard inclusions or exclusions, and the numbers and wordings of the clauses varies from organization to organization (both – PSUs and private insurance companies), however the contents i.e. Terms and Conditions remain more or less uniform based on the guidelines issued by IRDA (Insurance Regulatory and Development Authority) - a regulatory body for the Insurance sector in India which is a subject under Central Government of India.

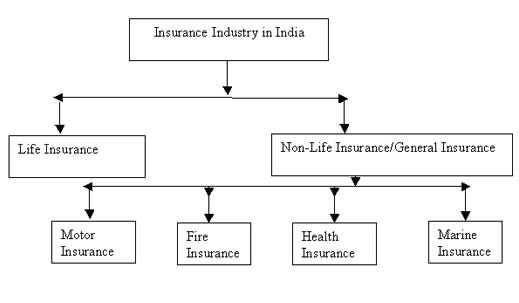

Broadly the Insurance sector is divided into Life insurance and General Insurance sector as depicted in the following table -

Classification of Indian Insurance Sector

As depicted in the classification chart, health insurance is one of the constituents of Non-Life/General Insurance sector in India.