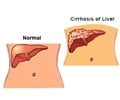

"Previous studies conducted in the United States and other countries have clearly shown that increasing alcohol taxes is associated with reduced overall consumption of alcohol as well as reduced heavy drinking. This new study shows that increasing taxes on alcohol also influences the death rate from liver cirrhosis, pancreatitis, gastric diseases, some cancers, and cardiovascular diseases caused by heavy alcohol use," said Maldonado-Molina.

The University of Florida study did not include deaths from traffic crashes, crime and violence associated with alcohol use, and therefore understates the total health effects of alcohol taxes.

The Florida legislature last increased the per gallon tax on beer in 1983 from 0.40 dollars to 0.48 dollars, the per gallon tax on wine from 1.75 dollars to 2.25 dollars, and the per gallon tax on spirits from 4.75 dollars to 6.50 dollars, and those rates remain in effect today.

"Because of the effects of inflation over the years, Florida's alcohol taxes in real terms are now only a quarter of what they were back in the 1960s," said Wagenaar.

"Simply returning the real tax rates to their levels in the 1960s would save the lives of some 1,500 Floridians per year from alcohol-related disease," he added.

Advertisement

Source-ANI