India may be one of the leading destinations in the world for Health Care Tourism because of its low cost health care system, but sadly this very same system is failing its own population. India’s problem with medical expenses is however quite different from the health care crisis of the United States, where the free market system in the latter allowed medical institutions and insurance companies to function solely on profits instead of service.

India has a mixed economy and there are plenty of hospitals run by the government that provide health care for free, or at nominal costs, making essential medical services affordable to all. The country’s public spending on health care is dismal with public financing for India’s health care accounting for less than 1% of global health care expenditure, despite the fact that the country accounts for 16% of the global population.India’s health care crisis is one that stems from government apathy and unrestricted population growth that in turn subjects the health care infrastructure to incredible strain — a burden that will only increase in the coming years. As is the rule of economics, inflation sets in when growing demand is met with diminishing supply and this is also true for medical services. Our mixed economy notwithstanding, we are rapidly approaching breaking point because of several oversights and issues.

Burgeoning Medical Expenses in India

To put this into perspective, it may help to look at some of the figures that reveal just how bad the problem is. Statistical data from World Health Organization also reveals some of the reasons for these escalating costs. According to WHO, despite the availability of health insurance in the country, most Indians are not covered and over two-thirds of the population still pay for medical treatments out of their own pocket. This means that people make huge payments towards health care out of their personal finances, rather than relying on insurance companies. In comparison, less than half the population in Sri Lanka and most other Asian countries rely on personal finances to make medical payments.Records from the National Sample Survey Office (NSSO) also reveal that healthcare expenditure in the country has risen in both rural and urban India, with a rise from 6.6% to 6.9% and 5.2% to 5.5% respectively between 2005 and 2012. PwC’s Health Research Institute estimates a further rise in costs this year from the 6.5% estimate for 2014 to 6.8% this year.

As medical costs escalate, the burden of ‘out of the pocket’ payments increases. Families can be left impoverished because of medical expenses and this often perpetuates a vicious cycle of borrowing, debt and bankruptcy. It may be surprising that so many millions of Indians are uninsured but reality is, only those who can least afford health care have no insurance and therefore have to pay the most.

The main reason for the poor insurance coverage is a lack of awareness among the general population. India has a number of private and government funded health insurers and a huge section of the population has some kind of access to health insurance. A few years ago, the General Insurance Corporation of India and the Insurance Regulatory and Development Authority even launched an initiative to increase public awareness about the need for health insurance and the cost of delaying enrollment. People often tend to procrastinate over tasks they do not see as urgent, especially if it involves a financial cost. Unfortunately, such delays can prove to be financially debilitating in the face of increase in medical emergency care and hospital incidental expenses.

Why are Medical Costs Hitting Indian Households so Hard?

The rising cost of health care is pushing up expenses as most Indians do not rely on health insurance, despite the fact that they could recover most of the costs of hospitalisation and medical care with insurance. Surveys suggest that just 10% of households have insurance for just a single member of the family. Some of the main factors that drive up health care costs for Indian families include the following:Public vs Private Hospitals

India has some of the best doctors in the world and many of them serve in government hospitals where treatment is affordable. Unfortunately, with our huge population and a concentration of low income population, these government services are stretched thin. As the demand for service increases so too does the waiting time to acquire any service. This increased waiting time drives many into the arms of private medical facilities where they are often squeezed dry.Medical Facilities and Professionals

The rate of expansion of medical colleges and medical institutions cannot keep pace with our rising population and this is imposing ever greater pressure on an already strained system. As these pressures increase, so does the cost of medical specialisation and training, and the costs of services provided by specialists who graduate from these institutes and so on.Cost of Medications

Although India has regulations to control drug prices unlike the United States, the cost of new drug development and other specialised medications has to be borne by the consumer. Pharmaceutical companies are profit driven and their costs are ultimately passed on to consumers.Clinical and Hospital Equipment

With new strides being made in technology all the time, clinics and hospitals alike need to keep upgrading their medical equipment whether for diagnostics or treatment. Patients who need to avail of these services ultimately pay the price and this can really hit you hard if you have to pay from your pocket. For example, standard imaging tests like MRIs and CT Scans can cost anywhere from Rs.5,000-Rs.12,000, obviously depending on the location and reputation of the clinic among other factors.Future Debt

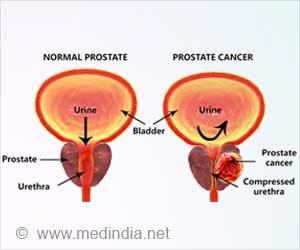

This is a growing problem, especially in urban areas. Lifestyle diseases are prevalent in most cities in India and diseases like cancer, coronary heart disease and diabetes really hit hard because the debt incurred from medical care for patients suffering from these conditions builds up over time. Moreover, lifestyle diseases affect both young and aged adults, often straining finances, especially in households with single wage earners. In such situations, the wage earner may be forced to seek loans to pay for medical expenses in the absence of insurance coverage for one’s self or parents or siblings. Debt incurred through borrowing is generally the hardest to repay and failing to make timely payments results in late fees and penalties that exacerbate the problem.Is there a Solution?

Although theoretically, health care is available to all Indians, it is often inaccessible or unaffordable for various reasons. Any solution to India’s health care crisis will probably take decades to come to fruition and this is time that we sorely lack. The crisis is expected to worsen considerably within the coming decades as India’s population is expected 1.4 billion by 2030, which would put it ahead of even China, as the most populous country. There can be no denying that the first step to finding any lasting solution for almost all of India’s ills would be to address the population crisis.Greater awareness among the population is absolutely vital as insurance can help shield the population from unforeseen medical expenses. People need to be made aware of low income health insurance and low cost health insurance plans so that more people are encouraged to move towards using health insurance as opposed to relying on out of the pocket payments for medical care.

On a positive note however, there has been a growing move towards health insurance, with awareness campaigns boosting these figures in the past decade. While there were just 55 million Indians with health coverage in 2003-4, this figure rose to 300 million in just 5-6 years. Going by these trends, the number of Indians with health coverage should touch 630 million by the end of this year.