Thousands of people could die from heart attacks if there was a widespread repetition of the crisis at Britain's Northern Rock bank, according to a study published by British researchers on Tuesday.

A team of sociologists at Cambridge University suggested that the stress of a system-wide banking crisis could lead to a 6.4-percent surge in heart attacks in high-income countries such as Britain and the United States.In Britain, from 1,280 to 5,130 people could die if a significant number of banks suffered a meltdown and developing countries could also be hit hard. In India, heart attacks could increase by as much as 26 percent, they said.

The study, entitled 'Can A Bank Crisis Break Your Heart?', based its findings on comparisons of World Health Organisation and World Bank data on mortality rates and previous banking crises between 1960 and 2002.

It was written after Northern Rock nearly collapsed last September when it was forced to apply for emergency central bank loans to stay afloat, prompting the first 'run' on a British bank in more than a century.

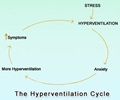

The study argued that banking crises -- and by extension large-scale economic turbulence -- are a 'significant determinant' of short-term increases in heart disease and mortality rates.

Cardiac deaths surge briefly and regularly every time there is a systemic bank failure, it said.

Advertisement

The old are particularly vulnerable because of the perceived risk to their lifetime of accumulated savings -- as well as their predisposition to conditions such as hypertension, it added.

Advertisement

'Coupled with the coverage of the crisis, that turned what might otherwise have been a momentary blip on the financial scene into an economic policy debacle.

'This report shows that containing hysteria and preventing widespread panic is important not only to stop these incidents leading to a systemic bank crisis, but also to prevent potentially thousands of heart disease deaths.'

Source-AFP

SRM/L